Taxes, Fairness, and the Surveillance State since the Eighteenth Century

Yanni Kotsonis

The Problem of Comparison

Just about every country in the world crafts revenue policies from a similar set of options: VAT or sales taxes, income taxes, property taxes, and excise taxes, with less use of tariffs over time. They are all based on economic surveillance. States might choose one or another emphasis – the UK and the USA with their reliance on direct income taxation, Greece on VAT, and Russia on the revenues of the petroleum industry – but they all use some of this mix, and all these measures rely on systems of information gathering. This implies that at their base, tax systems are deeply similar across national borders. This similarity not easy to observe because we write our histories as national histories and miss the comparisons. Any country looked at too closely will seem exceptional. We might insist that Russia was unusually brutal toward peasants who paid the most taxes (which in fact is not true by 1914), that Greeks today are unusually evasive, and that wealthy Americans and their corporations have manipulated the tax code to avoid their obligations. But if we were to read together Daunton on the history of British taxation, Delalande and Arnaud on French taxation, Assaf Likovski on Palestinian and Israeli taxation, and my work on Russian taxation, the patterns are unmistakable.[1] All countries underwent similar reforms around the same time, and these reforms were transformative.

What is more, these systems are quite new, put into place in the buildup to, and during, the First World War. But the war was the occasion, not the cause. They were all part of bringing more populations into the work of the state, and the new income tax declarations (the model was Prussia in 1891) were the embodiment: here the citizen revealed all, and indeed became a state bureaucrat by completing the form herself or himself.

To illustrate the evolution, consider this image of a peasant in Russia about to be beaten for his failure to pay taxes, in the 1870s:

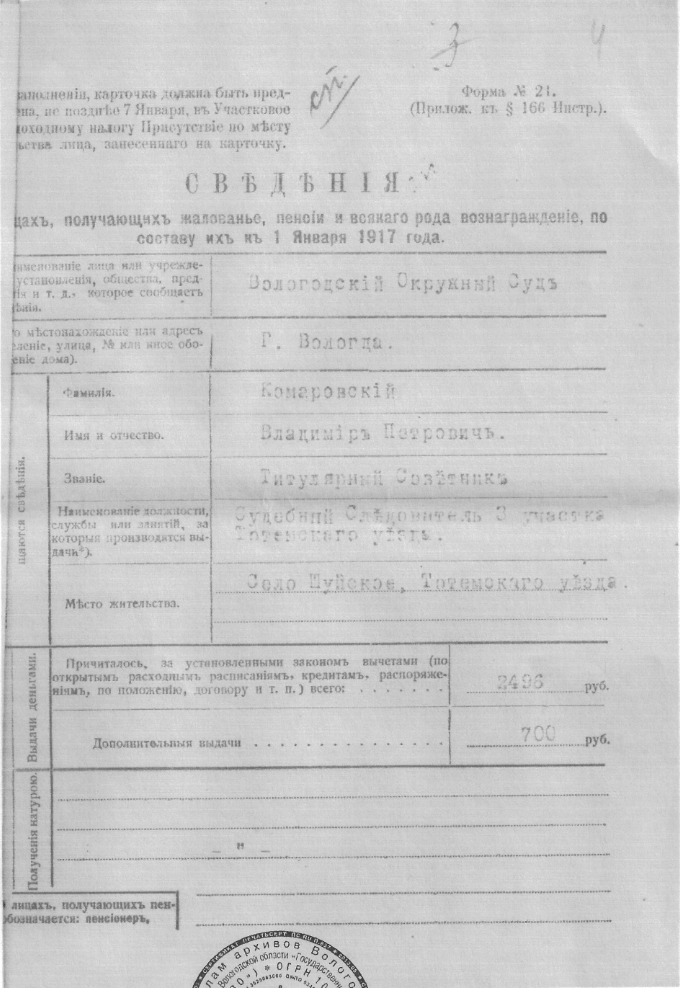

And compare it with this image, Russia’s first income tax form, in the city of Vologda in 1916:

The first was based on violence and proceeded from a command to pay, without knowing whether and how much the peasant could pay. The second is based on facts, provided by the payer himself. The first image concerns a peasant, part of the historic “taxable classes.” The second concerns a nobleman, historically exempted from taxes and now liable.

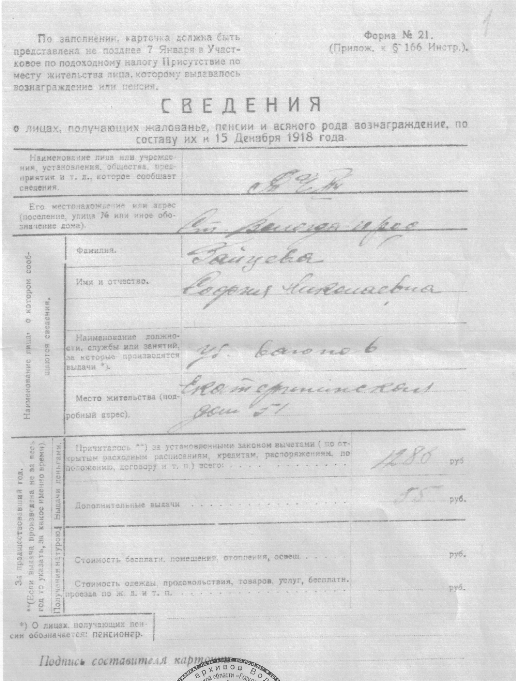

Next is a Soviet tax form of 1918, completed by a worker – a cleaner of railways wagons – and she too was required to pay. She protested that she was a worker in the workers’ state and should not pay at all. Soviet officials retorted that she was a citizen, and all citizens paid:

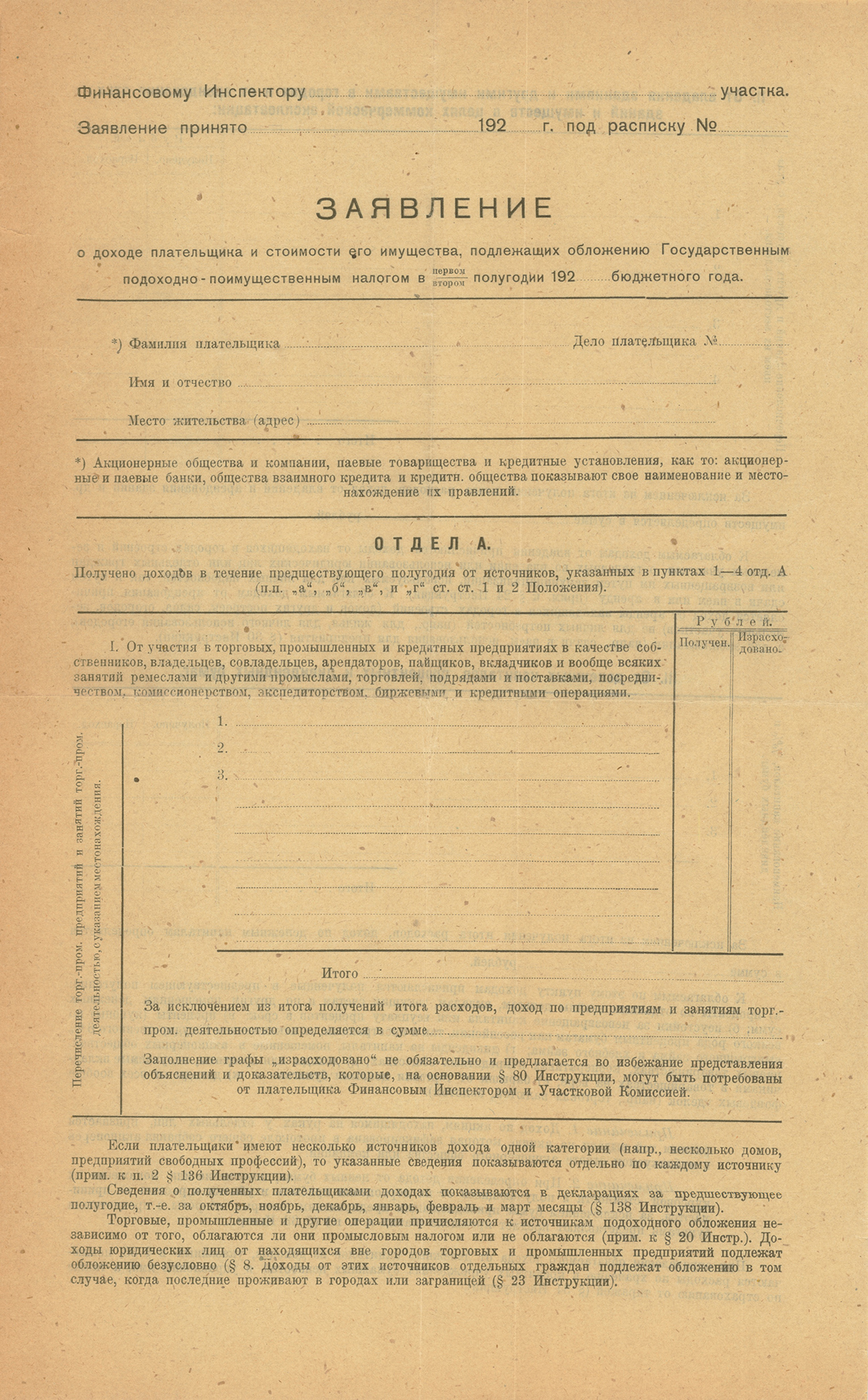

The form did not even ask her about her class, and nor did this form from 1925:

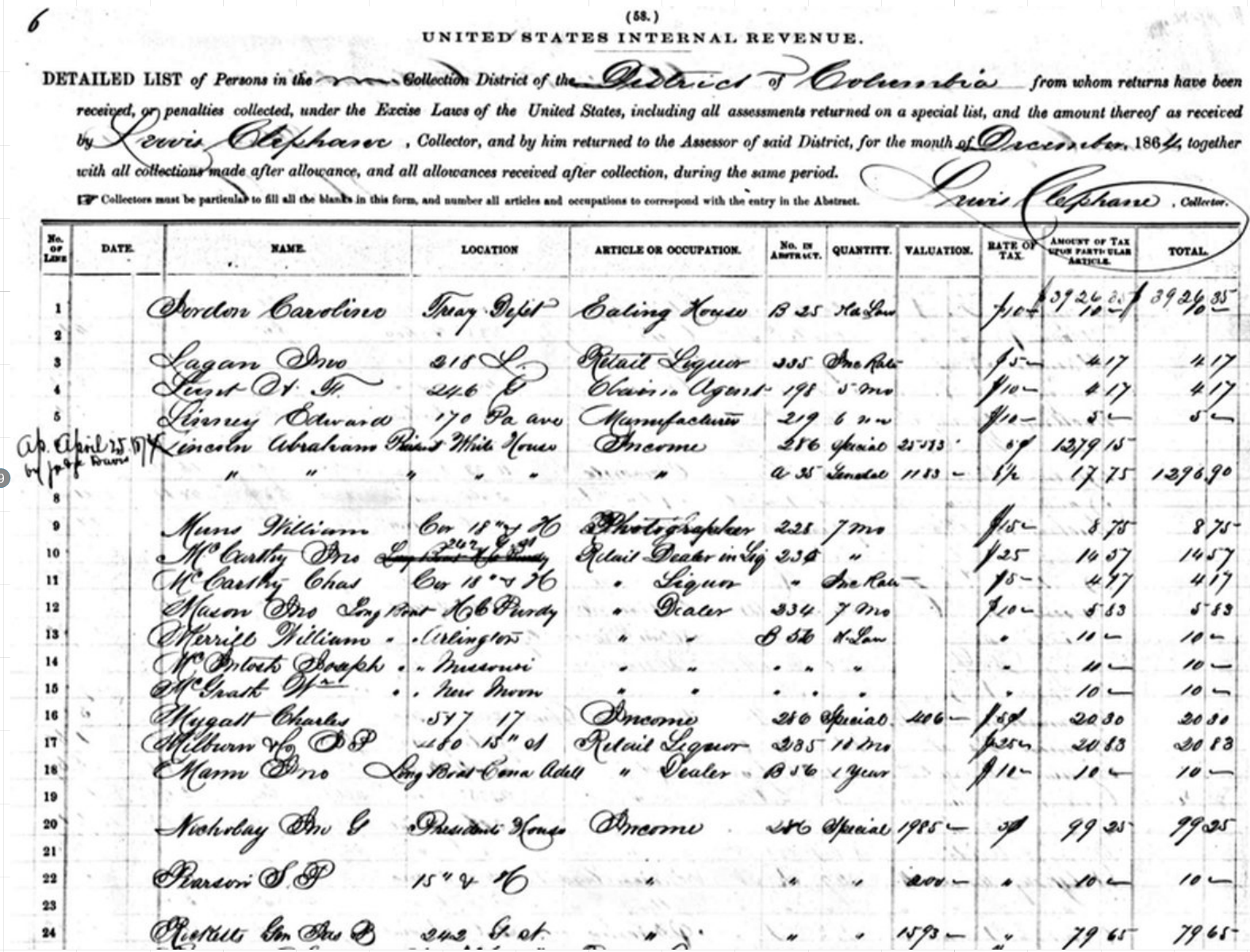

During the American Civil War a simple proto-income tax was introduced, and again all were expected to pay – including Abraham Lincoln on lines 6 and 7, at a time when heads of state were often still exempted:

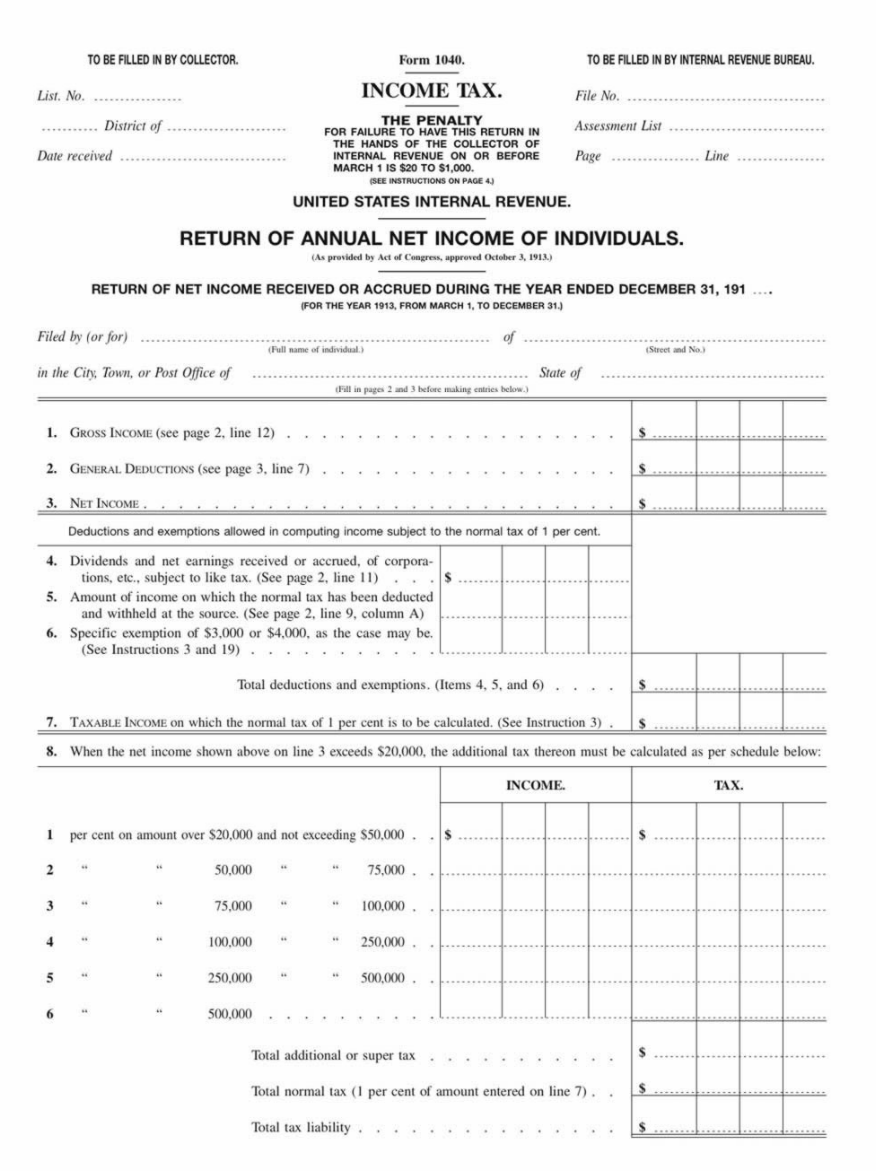

In 1913, the USA made the tax permanent, introducing the famous form 1040 that is still in use today.

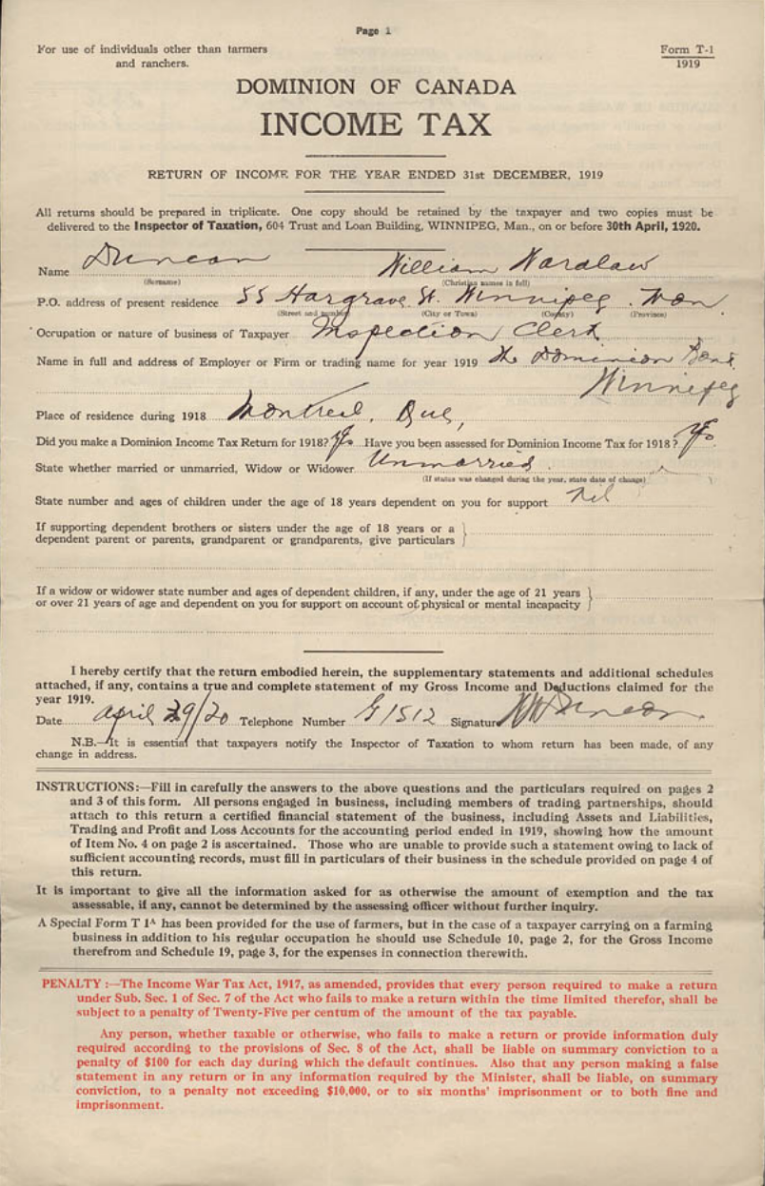

Canada was not far behind:

The problem then is to explain how such radically different regimes arrived at strikingly similar systems of taxation. Autocratic Russia and then the USSR, semi-absolutist Germany and then Weimar Germany, parliamentary Britain and Canada, republican France and the USA – these are regimes we treat as diametrically opposed or distinct, and yet they all learned from each other to arrive at almost identical measures.

Tax reform helped produce a new kind of state. All modern polities reformed themselves by reducing the distance between the state and the population, the state and the economy, the state and the person. The French did this through elections and called it democracy; the Russians did it through forced inclusion and also called it democratic – in the sense of including the population but not necessarily requesting its consent. But both of them accomplished the same goal through tax practices.

As the realms of human existence merged – as state and person and society and economy because identified – the sum became modern. In this there was a deep satisfaction expressed in the new harmony and communion of state and society, evident in any textbook that claims the polity is legitimate. It is also the source of anxiety that there was no way to escape a state that was, in the last analysis, ourselves.[2] All regimes retained the old character of the coercive state – the proverbial man with a stick – but they added to it a new character, whereby the state and the society became identified with each other. Lenin called this new kind of state “socialist,” managed like “a giant syndicate” that was inescapable: “there will be no place to go,” he promised and threatened in 1917.[3] But the west was doing something similar, as Nikos Poulantzas wrote: the state everywhere Janus-faced, it is both limited and all-encompassing, both coercive and consensual.[4] To put it another way, there were multiple ways to become modern and inclusive, and it was done by autocracies, democracies, monarchies and republics, with elections and without. Perry Anderson in his analysis of Gramsci could scarcely see the difference between a state that swallowed society (Russia) and a society that swallowed the state (the West).[5] In both cases the result was new totality or everything, and everything is equal to everything.

Political and Fiscal Revolutions

The great Atlantic revolutions of 1776 and 1789 (but not Haiti) began as classic tax rebellions, and their outcomes had everything to do with taxes. The great complaint of those revolutions was not that states taxed too much; it was that states were taxing arbitrarily and unfairly. The systems were deeply unfair because the people who could most afford to pay taxes – landed aristocrats, merchants, and royalty – were the ones who were exempted from taxation. This meant that wage earners, artisans, and peasants paid the bulk of the taxes, with a heavy reliance on the extremely burdensome capitation or soul taxes. The taxes were arbitrary because states had very little knowledge of personal or family wealth, little knowledge about the movement of goods, and therefore little basis to decide who should pay how much and who could not afford to pay at all. Instead tax collectors (often tax farmers and intermediaries who kept some revenues for themselves) took money from the most visible and vulnerable, while others in the same circumstances were entirely ignored.

The solution in the early nineteenth century was not to tax persons at all. The new principle was that the state should not encounter the payer. Britain gradually scaled back on direct personal taxes and relied on indirect taxes; they were unfair but they were universal, i.e., everyone paid, and tax was collected on the product rather than the person. France moved to taxing real estate and rents, meaning that the person was technically not taxed, and anyone with a property or a habitation paid something. Its advantage was that it was potentially universal. It was unfair because the state did not distinguish between rich and poor, again for lack of information. The US prohibited all federal taxes on persons, and relied into the twentieth century on tariffs, the least personal of all taxes. Russia began abolishing personal taxes in the 1860s and completed the process in the 1880s, and moved to systems of property and income taxation.

It was a classically liberal moment. Payers would have the right to be left alone, a kind of negative right measured by the extent to which the person was immune, what the state could not do. This meant that the state still had the problem of information: it could not ask a person what he or she had earned. But states did develop new techniques to guess, what was called exterior assessment. And it is important to understand that assessment had to be based on something demonstrable and some kind of fact. It would no longer be an arbitrary sum heaved upon an invisible population, what the English called “impost,” the French “impot,” the Russian podat. It should not be an external “burden,” what the Greeks called foros. Tax inspectors might count windows (more windows meant more heat and therefore more affluence), the arrival of workers and servants, the external measurements of a building, or the carts of goods leaving the premises. In France this produced very complicated coefficients relating an indicator to a presumed revenue (each window was associated with x francs of expenditure and thus income). French inspectors turned to philosophy to determine what kinds of investigation would not violate the privacy of the payer. Russian inspectors cited Adam Smith, John Stuart Mill, and Hegel to explain what they were doing.

The same principle – leaving the person alone – was extended to a new kind of revenue, the British income tax of 1842. It had been tried in Russia and Britain during the Napoleonic Wars and abandoned because of mass evasion; it was tried in the North of the USA during the Civil War and abandoned because it was unconstitutional. In 1842, when Peel repealed the Corn Laws and needed new revenue, the measure was reintroduced and became permanent. Here the British were recognizing that wealth was being generated in new ways in what was coming to be called capitalism. New forms of manufacturing and trade were producing wealth that was not associated with land and buildings and therefore was harder to locate. There were no hectares or windows to count. On the other hand, the inspector could not ask directly, for political reasons. Instead Britain elaborated the concept of “income,” which was not wealth. Wealth was private, an extension of the owner’s person. Income on the other hand was public and social by definition: as money moved from the hands of John to the hands of Harry, it was open to monitoring because it was a social act, and it was made possible by the protection of the state.

So the new income tax traced the movement of interest payments from banks (but not the bank accounts), yields on bonds and stocks, and the payments of any sort made by any one person or institution to another, and taxed it at a flat rate. It made the bourgeoisie liable but the flat rates were, still, extremely unfair since the working classes were paying on consumption a higher proportion of income. States still did not know how much a person or family earned and held in wealth, only individual pieces of information about certain kinds of income. By adding up these items, states produced their first estimates of “national income.” But they had no estimates of personal income.

Fiscal Anthropometrics: Dead Persons, Legal Persons, and Economic Personalities

The first solution to the problem of unfairness was embedded in the new taxes themselves: they produced information about properties and businesses, the movement of capital, and rents, since these were being measured more carefully to tax them properly. It was becoming easier to aggregate this kind of information in single persons and families, and to begin to develop a picture of the gross and net income of persons and families. The Prussians were the first large state to do so, in 1891, but there were also precedents that vaguely taxed “persons.” They were not our usual understandings of “persons” because some were juridical persons and others were dead. Corporate taxes were introduced in places like Russia (1885) and the USA (1909) as precedents because they were, technically speaking, “legal persons.” Unlike physical persons, they had no rights to privacy and existed thanks to the law, not God or nature. Their balances were public and published. It was an easy matter to require them to pay progressive income taxes, and the information needed was already available. The other precedent was inheritance taxes, where the payer was dead. Here the state claimed a share of the wealth or income acquired by a person in his or her lifetime, and taxed it on a scale. The dead person had no rights, only the privilege of testament. But the dead person was still a “person” for these purposes.

By the end of the century states were openly claiming that it was unfair and unjust to tax corporations and dead people on their aggregate income while living physical persons remained untaxed. Weren’t all of them “persons”?

Economists – in those days, not technicians and mathematicians but well educated thinkers – also developed a new term for the payer: the “economic personality,” the aggregate of all economic activities of a single person or head of household. In Prussia that meant men, in Russia it meant men and women without distinction. (“Women have the right to be taxed, too,” said a Russian fiscal expert.) I suspect the term was borrowed from psychoanalysis and by 1900 or so it was used commonly and naturally.[6] The information on a person’s income (salary, rent, revenue on capital) and expenses (family needs, investments, losses) was laid out as a profile (personality) that was detailed and intimate. It required that the person be divided into compartments and subcategories. Existing terms like “individual,” or the Greek equivalent “atom,” suited the immunity of the liberal individual of 1830. By 1890 the new term was “personality” precisely because the person was partitive, could be divided, and could be penetrated. It denied the immunity of the person from surveillance and investigation, and presupposed the person’s exposure and transparency. A Russian tax expert was both alarmed and impressed when he called it “fiscal anthropometrics,” the capacity of the treasury to produce a certain kind of person who was easily measured.

Modern Techniques of Surveillance

New techniques were brought to bear from the 1840s to 1916 and these were extremely controversial. The first was that each payer was required to complete the declaration and then swear to it; in those days it meant a religious oath. In Britain and then everywhere the first objection was that it was blasphemous. It elevated one’s responsibility to the state to the level of God. From the point of view of the state, it solved the problem of not having enough bureaucrats: it made everyone a bureaucrat, performing a state function. It also forced people to lie: it was well understood that payers avoided and evaded their tax dues, as they always had. It was quite normal. The new laws required the payer to swear that it was also true. Russians called it humiliating. In the past, when the tax inspector did not know what the payer had, he might propose a payment of, say, 100 rubles. They payer might respond with 40. With a small bribe, they might agree on 50. But once the inspector knew for a fact that Ivan had 2000 rubles in income, he could confidently demand the full 100 rubles. Facts were facts, and the inspectors were well paid and less easy to bribe.

The second device was reporting. Each employer and every financial institution was required to report to the state what was paid out and to whom, which meant that every citizen was “narking” on every other. The next provision, deductions, was even worse, or better: in order to reduce a tax bill, a payer could declare payments to a builder of a factory building or to a supplier of raw materials. He or she then paid less tax. But the person to whom the money was paid now had a new tax bill, thanks to the information provided by one’s fellow citizen. Foucault would have been proud: If this was oppression, then it was practiced by the citizen on the citizen, not the state on the citizen. It was disciplinary, not coercive: the payer never knew if and when he would be caught, and regarded the inspector as a Sword of Damocles. And just to complete the logic, some countries like Germany, Britain, and Russia had elected commissions for tax assessment, by county or neighborhood. (Women could vote for these even though they did not have the right to vote in national elections, until Russia introduced it in 1917.) It meant that every neighbor was being assessed by a neighbor, every oppression practiced by the citizen on the citizen. Like jury duty, it made the law legitimate by requiring the population to practice it.

Finally, all this information could be supplemented with what we now call data mining. A payer may underestimate income when reporting to the government, but he would be frank when reporting information to an insurance company for damages or a mortgage company for a loan. Since the payer voluntary surrendered information to those companies, it was not private; it could be harvested by the state and used to revise the tax assessment.

The good tax system was a Panopticon of full visibility: not only was there an inspector watching from the middle of the process, but each inmate could see every other.

Are All States the Same?

The differences among regimes still matter, and even if a state looks similar it exists in a distinct regime. Consider this by way of example, which comes from Russia in 1906. At that moment Russia was in the midst of a revolution that threatened to bring down the autocracy, when Trotsky seemed likely to arrest the government before the government could arrest Trotsky. The government chose this moment to enact the income tax because, it claimed, there was a budget gap that needed to be filled. That was not entirely true, and the budget was an excuse to enact something that had been on the minds of officials for at least a decade. The other explanation was more plausible. Russia needed to narrow the gap between state and society, since the revolution was caused by their mutual alienation. It was time, the officials declared, to bring society into the state and the income tax would do just that. Along the way they invited to their meetings bankers, to inform them that they would have to report their clients to the state. The bankers objected in stages. The lifting of privacy was a violation of a individual rights. Russia did not have a word for “individual” or “atom” as in “indivisible,” so the banker said it in Latin: “individuum.” Officials countered that (1) the issue was the visibility of the citizen, and (2) “privacy” in Russia could mean “selfish” just as in other languages “private” could mean “idiot.” The bankers persisted. A credit institution (by liberal philosophy) was a form of private property, and is the same as the person per se. To violate my property is to violate my person, and the bank is “my very self” (moyo ia). The officials retorted: the self is a legal category, and it exists thanks to the law, and the law can be changed. In the end the law in Russia was amended to lift virtually all immunities and protections of confidential transactions. The same law was passed in Soviet Russia.

And the point: most of the regimes in question entailed an interplay of the state with the economy, the state with the person, the state with the population. The pendulum might swing and shift, but the interplay was ongoing. In Russia by 1917, and for many years after, the entities merged. There really was “no place to go.”

Final Assessment: Liberalism and Social Fairness

A tax system cannot be fair without detailed knowledge of incomes and transactions. The gathering of information by the state, if well regulated, is a small price to pay for the services that a state provides – schools, child care, medical services, roads. Anyway, we voluntary surrender much more information to Google and FaceBook completely willingly.

And yet we seem alarmed when this information is gathered by state, as if we are afraid of the word “state.” We deliver more information to corporations that are larger than most states. And we make our systems regressive. VAT systems do rely on detailed knowledge, but of consumption and production, not individual capacities. And yet states have turned to these systems of unfair taxation increasingly and they have made income taxes regressive. It may be out of ideological considerations (the right of people to pay fewer taxes as an anti-state stance, especially if their incomes are high), or because evasion is so rampant that only a VAT can secure state revenue. But progressive taxation on incomes is by far the most fair and effective because it follows the economy. States that have the capacity to make it work (Greece) have in the past renounced their powers. Best I can tell, it’s a special social contract: if the government will not enforce the laws, the citizens will vote for them; the kiosk owner is pleased to hide 500 euros under the mattress, the commercial capitalist is happy to hide 5 million in an off-shore account. Somehow they think they are in this together in an anti-state solidarity. Again, this is not exceptional: poor American voters agree that the rich should pay less tax, as if they share in the liberty of a billionaire. I do not think that’s the case at all: it is better to measure a shared social loss, and the less wealthy one is, the greater his or her loss.

And yet most commercial economies, including Greece, have the tools to implement proper income taxation and progressive rates. What is missing is the will. I expect better of the current government and I wish it well.

NOTES:

1. Daunton, Martin J., Trusting Leviathan: The Politics of Taxation in Britain, 1799-1914 (Cambridge, 2001); Delalande, Nicolas, Les Batailles de l’impôt. Consentement et resistances de 1789 à nos jours (Paris, 2011); Ardant, Gabriel, Histoire de l’impôt, t. 2, [Du] Xllle [au] XXIe siècle (Paris, 1972); Likhovski, Assaf, Tax Law and Social Norms in Mandatory Palestine and Israel (Cambridge, 2017); Kotsonis, Yanni, States of Obligation: Taxes and Citizenship in Imperial Russia and the Early Soviet Republic (Totonto, 2014).

2. Giddens, Anthony, The Consequences of Modernity (Stanford, 1990). Lenin, V. I. “Gosudarstvo i revoliutsiia.” In Polnoe sobranie sochinenii. 5th edition. Moscow, 1959: 33:1-120.

3. Lenin, V. I., “Gosudarstvo i revoliutsiia,” in Polnoe sobranie sochinenii, 5th edition (Moscow, 1959), vol. 33, pp.1-120.

4. Poulantzas, Nicos. State, Power, Socialism, Translated by Patrick Camiller (London, 1978).

5. Anderson, Perry, “The Antinomies of Antonio Gramsci,” New Left Review I/100 (1976), pp. 5-78.

6. As by the American tax expert, trained in Germany and a propagandist for the personal income tax: Seligman, Edwin R. A., The Income Tax: A Study of the History, Theory, and Practice of Income Taxation at Home and Abroad, Second edition (New York, 1914).

(CHRONOS, June 2nd, 2018)

![]()

If we were to read together Daunton on the history of British taxation, Delalande and Arnaud on French taxation, Assaf Likovski on Palestinian and Israeli taxation, and my work on Russian taxation, the patterns are unmistakable. All countries underwent similar reforms around the same time, and these reforms were transformative.

Autocratic Russia and then the USSR, semi-absolutist Germany and then Weimar Germany, parliamentary Britain and Canada, republican France and the USA – these are regimes we treat as diametrically opposed or distinct, and yet they all learned from each other to arrive at almost identical measures.